A Biased View of Medicare Graham

A Biased View of Medicare Graham

Blog Article

The Ultimate Guide To Medicare Graham

Table of ContentsIndicators on Medicare Graham You Should KnowThe Buzz on Medicare Graham10 Simple Techniques For Medicare GrahamTop Guidelines Of Medicare GrahamMedicare Graham for DummiesGetting The Medicare Graham To Work7 Simple Techniques For Medicare Graham

The phone number for the Social Safety and security office in your area can be found in the Important Phone Figures section of this website.There are some Medicare Wellness Strategies that cover prescription medicines. You can likewise check right into obtaining a Medigap or additional insurance policy for prescription drug protection.

The Ultimate Guide To Medicare Graham

Medigap plans are personal health and wellness insurance policy policies that cover some of the expenses the Original Medicare Plan does not cover. Some Medigap policies will certainly cover solutions not covered by Medicare such as prescription medicines.

Your State Insurance Department can address questions about the Medigap plans sold in your location. Check the Important Phone Figures section of this internet site for the phone number of your State Insurance Division. If you have actually operated at least one decade in Medicare covered employment you will certainly get approved for exceptional cost-free Medicare Part A (Healthcare Facility Insurance Coverage).

Some Known Details About Medicare Graham

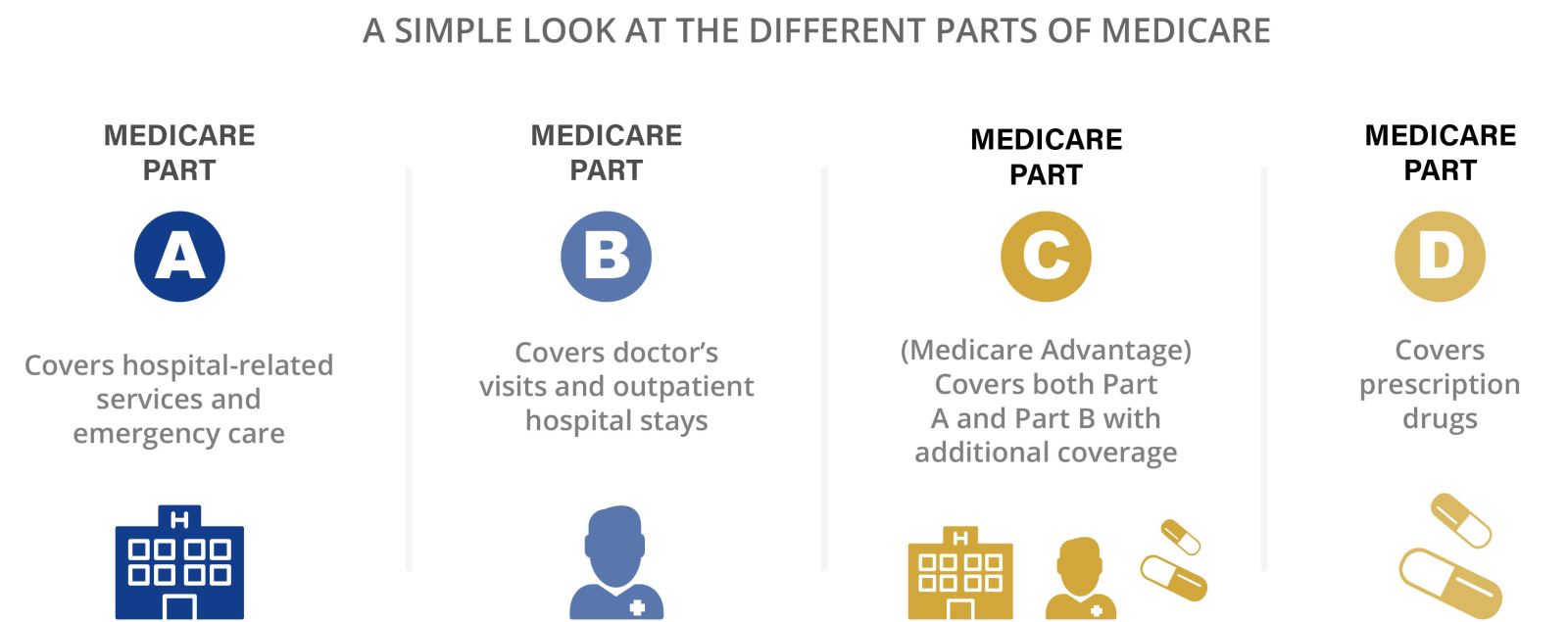

Check the Important Phone Numbers section of this web website for the contact number of the Social Safety And Security Office in your area. Medicare Part B assists pay for physicians' solutions, outpatient healthcare facility care, blood, medical devices and some home wellness services. It also pays for other clinical solutions such as laboratory examinations and physical and occupational therapy.

Getting My Medicare Graham To Work

Medicare does not cover insulin and syringes. A deductible is the amount you need to pay each year prior to Medicare starts paying its part of your medical expense. Medicare.

Your insurance deductible is taken out of your cases when Medicare obtains them. Medicare handled care strategies are an additional means for you to obtain Medicare advantages.

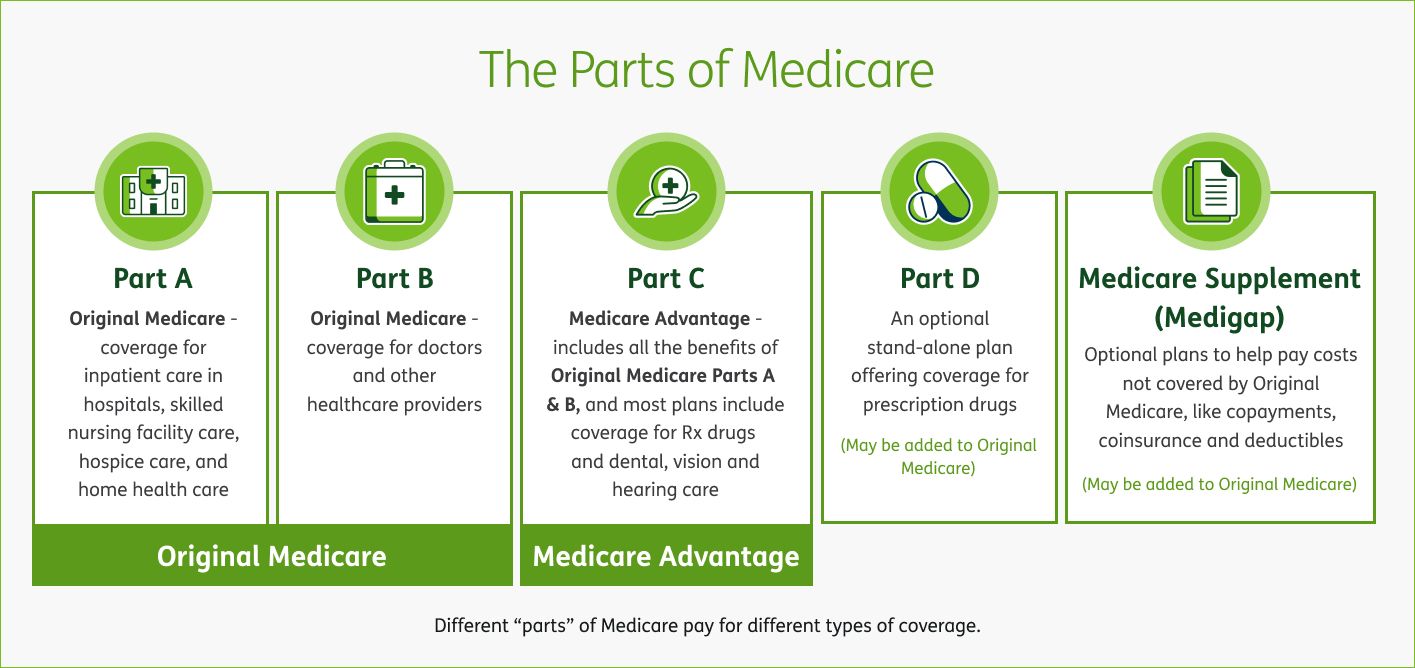

There are 4 components of Medicare: Part A, Part B, Component C, and Component D. As a whole, the four Medicare components cover various solutions, so it's vital that you recognize the options so you can pick your Medicare protection carefully. Possibly you're getting near the age of 65 or merely want to understand how Medicare works so you can assist a member of the family or good friend.

Whatever your situation, you become qualified for Medicare when you reach 65. If you currently obtain Social Protection, you'll be registered in Medicare immediately the month you turn 65. For many individuals, there is no month-to-month expense for Component A if you or your partner paid Medicare taxes for at the very least 10 years.

Then, you pay $0 for the very first 60 days of coverage. Co-payments obtain remains beyond 60 days and you spend for the whole of your healthcare facility stay after 150 days. Although Medicare Component A covers hospice care at an inpatient center, it has to be arranged through a Medicare-approved hospice service provider.

How Medicare Graham can Save You Time, Stress, and Money.

Kathryn B. Hauer, a financial advisor at Wilson David Investment Advisors and the writer of Financial Guidance for Blue Collar America, cautions that ravaging ailments such as cancer can wreck your finances in retirement and advises Medicare recipients to think about extra coverage. She notes that Medicare customers without Medigap insurance coverage spend 25% to 64% of their earnings on clinical costs.

The smart Trick of Medicare Graham That Nobody is Discussing

(https://sandbox.zenodo.org/records/163182)Medicare will certainly cover acute-care health center services for people that are moved from an intensive treatment or crucial treatment system. Depending on your strategy, you might need to pay an annual deductible prior to qualified drug costs are covered, and some Part D strategies have a co-pay.

Report this page